What is the Stability Pool?

The stability pool is a smart contract which acts as the first line of defense in the event that collateral debt positions in the system fall below the minimum collateral ratio threshold (%110 in regular mode, 150% in Recovery Mode). The stability pool acts as the liquidity to repay debts from these loans that are liquidated at collateral ratios lower than 110% (150% in Recovery mode).

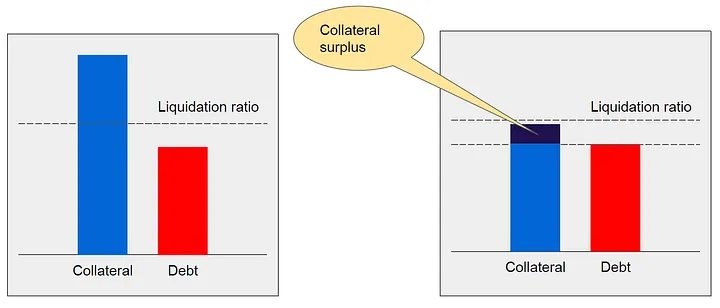

The Stability Pool is funded by users transferring CUSD into it (called Stability Providers). Over time Stability Providers lose a pro-rata share of their CUSD deposits, while gaining a pro-rata share of the liquidated collateral tokens (WCRO etc.). However, because Loans are likely to be liquidated at just below 110% collateral ratios, it is expected that Stability Providers will receive a greater dollar-value of collateral relative to the debt they pay off (yield).

Essentially users deposit CUSD stablecoins to earn yield paid out in collateral tokens (wcro, weth, wbtc). This creates a popular and historically profitable strategy of earning yield paid out in crytpocurrencies from depositing stablecoins.

How do I benefit as a Stability Provider from liquidations?

Because liquidations will happen just below a collateral ratio of 110%, you will most likely experience a net gain whenever a Loan is liquidated. The stability pool funds are used to pay back to loan (in CUSD) and so the 0-10% difference in collteral ratio (~110%-100%) is rewarded to the providers in collateral tokens.

Example scenario:

user1 deposits $1000 CUSD in Stability Pool

WCRO price falls and user2 Loan collateral ratio drops just below 110% at 109.9% ($109.9 value of WCRO collateral with $100 CUSD loan)

user3 sees opportunity and liquidates user2 Loan

$100 CUSD is taken from stabiltiy pool to pay back loan, collateral $109.9 of WCRO is given to user1, $20 CUSD liquidation fee is given to user3

Note that depositors can immediately withdraw the collateral received from liquidations and sell it to reduce their exposure to WCRO, if the USD value of WCRO is expected to decrease.

Last updated